Microwave Metamaterials Engineering in 2025: How Advanced Materials Are Powering a 30% Market Surge and Transforming Wireless, Defense, and Sensing Technologies. Explore the Innovations and Strategic Shifts Shaping the Next Five Years.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Overview: Fundamentals of Microwave Metamaterials

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Emerging Applications: Wireless Communications, Sensing, and Imaging

- Defense and Aerospace: Strategic Adoption and Breakthroughs

- Key Players and Industry Initiatives (e.g., ieee.org, nist.gov, raytheon.com)

- Manufacturing Advances: Materials, Processes, and Scalability

- Regulatory Landscape and Standardization Efforts

- Investment Trends, M&A, and Startup Ecosystem

- Future Outlook: Innovation Roadmap and Long-Term Opportunities

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

The global landscape for microwave metamaterials engineering is poised for significant advancement in 2025, driven by escalating demand for next-generation wireless communications, advanced radar systems, and electromagnetic interference (EMI) mitigation. Metamaterials—engineered composites with properties not found in nature—are increasingly being integrated into microwave devices to achieve unprecedented control over electromagnetic waves, enabling miniaturization, improved efficiency, and novel functionalities.

Key market drivers in 2025 include the rapid deployment of 5G and the early-stage rollout of 6G networks, which require components with superior beam steering, filtering, and low-loss characteristics. Major telecommunications equipment manufacturers and network providers are investing in metamaterial-based antennas and filters to enhance signal quality and reduce device footprints. For instance, Ericsson and Nokia are actively exploring advanced materials for next-generation base stations and user devices, with metamaterials featuring prominently in their R&D pipelines.

In the defense and aerospace sectors, the adoption of microwave metamaterials is accelerating for applications such as stealth technology, adaptive radomes, and high-performance sensors. Companies like Lockheed Martin and Northrop Grumman are developing metamaterial-enabled solutions to enhance radar cross-section reduction and electromagnetic compatibility in military platforms. These efforts are supported by government-funded research initiatives and collaborations with academic institutions, aiming to transition laboratory breakthroughs into deployable systems within the next few years.

Commercialization is further propelled by specialized metamaterial manufacturers such as Meta Materials Inc., which supplies tunable microwave components and EMI shielding solutions to both industrial and consumer electronics markets. The company’s partnerships with global OEMs underscore the growing confidence in the scalability and reliability of metamaterial-based products.

Looking ahead, the market outlook for microwave metamaterials engineering in 2025 and beyond is characterized by robust growth prospects, with increasing cross-sector adoption and expanding application domains. Key challenges remain in large-scale manufacturing, cost reduction, and standardization, but ongoing investments by industry leaders and the emergence of dedicated supply chains are expected to address these hurdles. As a result, microwave metamaterials are set to become foundational to the next wave of innovation in wireless communications, defense, and advanced sensing technologies.

Technology Overview: Fundamentals of Microwave Metamaterials

Microwave metamaterials are artificially structured materials engineered to control electromagnetic waves in the microwave frequency range (typically 1–100 GHz) in ways not possible with conventional materials. The fundamental principle behind these materials is the subwavelength structuring of their constituent elements, which enables the manipulation of effective permittivity and permeability, resulting in unique electromagnetic responses such as negative refractive index, cloaking, and superlensing.

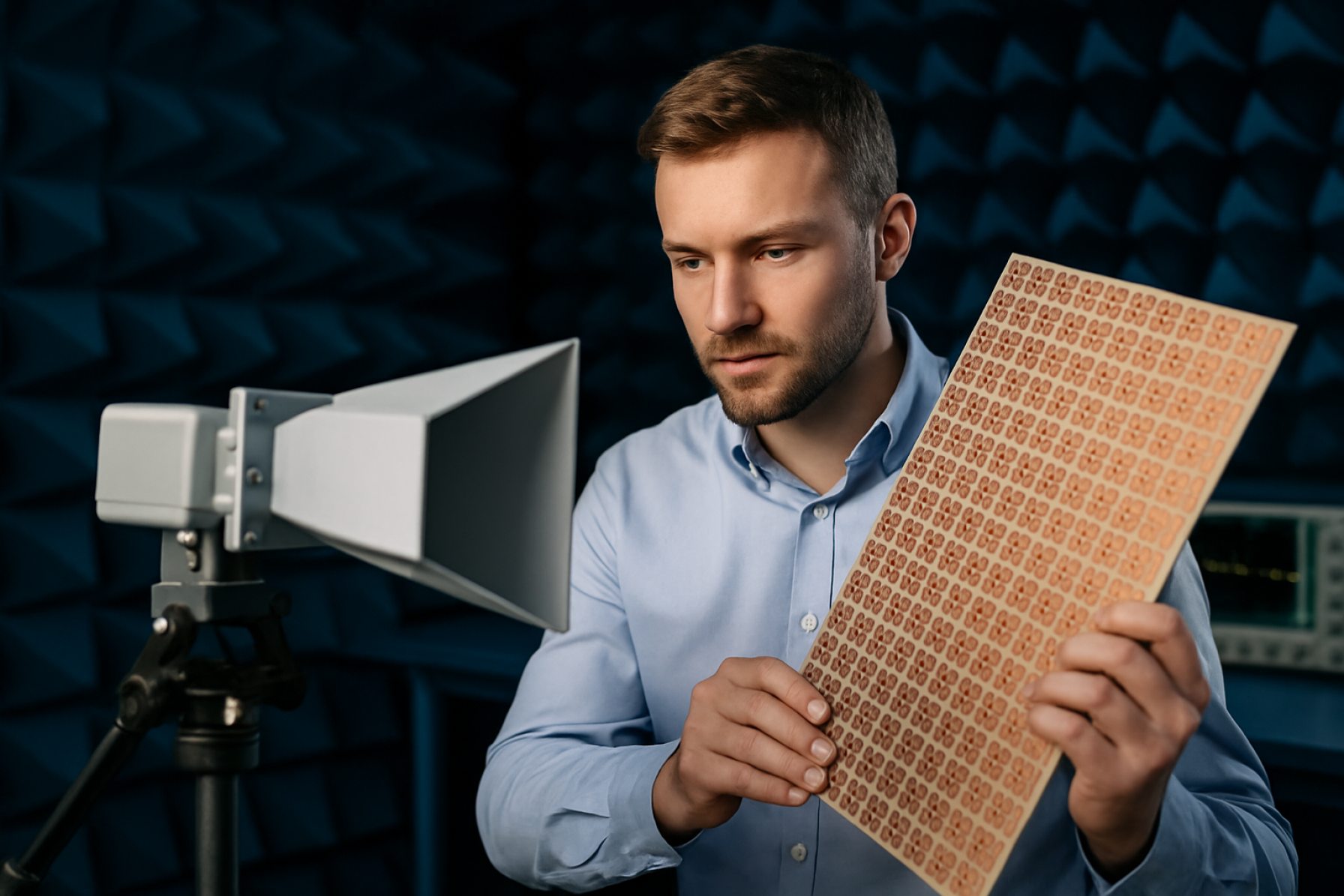

The engineering of microwave metamaterials involves the precise design and fabrication of periodic or aperiodic arrays of resonant elements—such as split-ring resonators, complementary structures, or patterned metallic inclusions—on dielectric substrates. These structures are typically realized using advanced printed circuit board (PCB) manufacturing, photolithography, or additive manufacturing techniques. The choice of substrate, conductor, and geometry is critical, as it determines the operational bandwidth, loss characteristics, and integration potential with existing microwave systems.

In 2025, the field is witnessing rapid advancements in both simulation and fabrication capabilities. Electromagnetic simulation software, such as those provided by ANSYS and CST (a Dassault Systèmes brand), enables the accurate modeling of complex metamaterial structures, allowing engineers to optimize designs for specific applications such as beam steering, filtering, and electromagnetic interference (EMI) mitigation. These tools are essential for predicting the effective medium parameters and guiding the iterative design process.

On the manufacturing side, companies like Rogers Corporation and TDK Corporation supply high-performance dielectric substrates and advanced materials that are widely used in the fabrication of microwave metamaterials. Their materials offer low loss, high thermal stability, and compatibility with high-frequency circuit integration, which are crucial for practical deployment in telecommunications, radar, and sensing systems.

Recent years have also seen the emergence of tunable and reconfigurable microwave metamaterials, leveraging technologies such as microelectromechanical systems (MEMS), varactor diodes, and phase-change materials. These innovations enable dynamic control over metamaterial properties, paving the way for adaptive antennas, programmable surfaces, and next-generation wireless devices. Companies like Nokia and Ericsson are actively exploring the integration of metamaterial-based components into 5G and future 6G infrastructure, aiming to enhance signal control, reduce interference, and improve energy efficiency.

Looking ahead, the fundamentals of microwave metamaterials engineering are expected to evolve rapidly, driven by advances in materials science, nanofabrication, and computational electromagnetics. The continued collaboration between material suppliers, device manufacturers, and telecommunications leaders will be pivotal in translating laboratory breakthroughs into scalable, real-world solutions over the next few years.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The global market for microwave metamaterials engineering is poised for robust growth between 2025 and 2030, driven by escalating demand in telecommunications, defense, aerospace, and next-generation wireless infrastructure. As of 2025, the market is characterized by a surge in R&D investments and increasing commercialization of advanced metamaterial-based components, such as antennas, absorbers, and filters, which are critical for 5G/6G networks, radar systems, and satellite communications.

Key industry players—including Northrop Grumman, a leader in defense and aerospace metamaterial applications, and Kymeta Corporation, known for its metamaterial-based satellite antennas—are expanding their product portfolios and scaling up production. Meta Materials Inc. is another prominent company, focusing on commercializing metamaterial solutions for electromagnetic interference shielding and advanced antenna systems. These companies are actively collaborating with telecommunications providers and government agencies to accelerate the deployment of metamaterial-enabled devices.

Revenue projections for the microwave metamaterials sector indicate a compound annual growth rate (CAGR) in the range of 20–25% from 2025 to 2030, with the market expected to surpass the USD 2 billion mark by the end of the forecast period. This growth is underpinned by the rapid adoption of metamaterial-based components in phased array antennas, beam-steering devices, and stealth technologies. The defense sector, in particular, is anticipated to remain a dominant revenue contributor, as organizations such as Lockheed Martin and Raytheon Technologies continue to integrate metamaterial solutions into radar and electronic warfare systems.

Geographically, North America and Asia-Pacific are projected to lead market expansion, fueled by significant investments in 5G/6G infrastructure and government-backed research initiatives. The European market is also witnessing increased activity, with companies like Airbus exploring metamaterial applications for aerospace and satellite communications.

Looking ahead, the outlook for microwave metamaterials engineering remains highly positive. The convergence of advanced manufacturing techniques, such as additive manufacturing and nanofabrication, with metamaterial design is expected to further reduce costs and enable mass-market adoption. As industry standards mature and supply chains stabilize, the sector is set to transition from niche applications to mainstream deployment across multiple high-growth industries by 2030.

Emerging Applications: Wireless Communications, Sensing, and Imaging

Microwave metamaterials engineering is rapidly advancing, with 2025 marking a pivotal year for the deployment of these materials in wireless communications, sensing, and imaging. The unique ability of metamaterials to manipulate electromagnetic waves at subwavelength scales is enabling a new generation of devices with enhanced performance and novel functionalities.

In wireless communications, metamaterials are being integrated into antennas and radio frequency (RF) components to improve bandwidth, directivity, and miniaturization. Companies such as Nokia and Ericsson are actively exploring metamaterial-based antenna arrays for 5G and emerging 6G networks, aiming to achieve higher data rates and more efficient spectrum utilization. These advancements are particularly relevant as the industry prepares for the densification of networks and the proliferation of Internet of Things (IoT) devices. Metamaterial-enabled reconfigurable intelligent surfaces (RIS) are also being trialed to dynamically control signal propagation in complex urban environments, with early demonstrations showing significant improvements in coverage and energy efficiency.

In the field of sensing, microwave metamaterials are being leveraged to enhance the sensitivity and selectivity of sensors used in security screening, industrial process monitoring, and biomedical diagnostics. Honeywell and Thales Group are among the organizations developing metamaterial-based sensors capable of detecting minute changes in environmental parameters or the presence of specific chemical and biological agents. These sensors benefit from the engineered resonant properties of metamaterials, which can be tailored for specific frequency responses and high signal-to-noise ratios.

Imaging applications are also witnessing significant breakthroughs. Metamaterial-based microwave lenses and cloaking devices are being prototyped for use in security, medical imaging, and non-destructive testing. Lockheed Martin has reported progress in integrating metamaterial components into radar and imaging systems, aiming to achieve higher resolution and stealth capabilities. The ability to focus and steer microwave beams with unprecedented precision is expected to open new possibilities in through-wall imaging and concealed object detection.

Looking ahead, the next few years are expected to see the commercialization of metamaterial-enabled devices across these sectors. The convergence of advanced manufacturing techniques, such as additive manufacturing and large-area printing, with metamaterial design is reducing production costs and accelerating time-to-market. As industry standards evolve and pilot projects transition to full-scale deployment, microwave metamaterials are poised to become foundational to next-generation wireless, sensing, and imaging technologies.

Defense and Aerospace: Strategic Adoption and Breakthroughs

Microwave metamaterials engineering is rapidly transforming the defense and aerospace sectors, with 2025 marking a pivotal year for both strategic adoption and technological breakthroughs. These engineered materials, designed to manipulate electromagnetic waves in ways not possible with natural substances, are enabling new capabilities in stealth, sensing, and communications.

A primary area of focus is radar cross-section (RCS) reduction for military platforms. Metamaterial-based coatings and structures are being integrated into next-generation aircraft and unmanned aerial vehicles (UAVs) to enhance stealth. For example, Lockheed Martin—a leader in advanced defense technologies—has publicly discussed research into metamaterial applications for electromagnetic signature management, aiming to further reduce detectability of their platforms. Similarly, Northrop Grumman is investing in adaptive metamaterial surfaces for both air and space vehicles, targeting dynamic control over electromagnetic properties to counter evolving radar threats.

In the realm of communications, microwave metamaterials are being leveraged to develop compact, high-gain antennas and reconfigurable surfaces. These advances are critical for secure, jam-resistant links in contested environments. Raytheon Technologies is actively developing metamaterial-enabled phased array antennas for military and satellite communications, aiming for lighter, more agile systems with enhanced beam steering capabilities. The U.S. Department of Defense, through agencies such as DARPA, continues to fund metamaterial research for next-generation electronic warfare and sensor systems, with several prototype demonstrations expected by 2025.

Aerospace applications are also expanding, with companies like Airbus exploring metamaterial-based solutions for satellite payloads and aircraft electromagnetic shielding. These innovations promise to improve signal integrity and reduce electromagnetic interference, which is increasingly important as aircraft and spacecraft become more electronically complex.

Looking ahead, the next few years are expected to see the transition of microwave metamaterials from laboratory-scale demonstrations to fielded systems. Key challenges remain in large-scale manufacturing, reliability under operational conditions, and integration with legacy platforms. However, with sustained investment from major defense contractors and government agencies, the outlook for microwave metamaterials in defense and aerospace is robust. The sector is poised for breakthroughs that will redefine electromagnetic performance and survivability in complex operational theaters.

Key Players and Industry Initiatives (e.g., ieee.org, nist.gov, raytheon.com)

The field of microwave metamaterials engineering is experiencing significant momentum in 2025, driven by a combination of established defense contractors, innovative startups, and collaborative industry-academic initiatives. Key players are focusing on the development of tunable, low-loss, and scalable metamaterial solutions for applications ranging from advanced radar systems to next-generation wireless communications.

Among the most prominent organizations, Raytheon Technologies continues to invest heavily in metamaterial-based microwave components, leveraging their expertise in defense electronics to develop adaptive radomes and beam-steering antennas. Their work is closely aligned with the needs of military and aerospace clients, where metamaterials offer advantages in stealth, signal control, and miniaturization.

On the standards and measurement front, National Institute of Standards and Technology (NIST) plays a pivotal role. NIST is actively engaged in the characterization and benchmarking of microwave metamaterials, providing the industry with validated measurement protocols and reference materials. Their efforts are crucial for ensuring interoperability and reliability as commercial and defense applications scale up.

The Institute of Electrical and Electronics Engineers (IEEE) is another central force, facilitating the dissemination of research and the establishment of technical standards. Through its conferences, journals, and working groups, IEEE supports the global exchange of knowledge on topics such as reconfigurable metasurfaces, non-reciprocal devices, and integration with 5G/6G systems.

In the commercial sector, companies like Metamaterial Inc. are pushing the boundaries of scalable manufacturing for microwave metamaterials. Their proprietary roll-to-roll fabrication techniques and partnerships with telecommunications firms position them as leaders in supplying tunable filters, absorbers, and beamformers for both defense and civilian markets.

Startups and university spin-offs are also making notable contributions. For example, Kymeta Corporation specializes in electronically steered flat-panel antennas based on metamaterial technology, targeting satellite communications and connected vehicles. Their products are already being deployed in commercial and government fleets, demonstrating the viability of metamaterials in real-world, high-frequency environments.

Looking ahead, industry initiatives are increasingly collaborative, with consortia forming to address challenges in cost, scalability, and integration. The next few years are expected to see further convergence between microwave metamaterials engineering and emerging fields such as quantum sensing and terahertz communications, with key players continuing to drive innovation and standardization across the sector.

Manufacturing Advances: Materials, Processes, and Scalability

The field of microwave metamaterials engineering is experiencing significant advances in manufacturing, driven by the need for scalable, cost-effective, and high-performance solutions for applications in telecommunications, defense, and sensing. As of 2025, the focus has shifted from laboratory-scale fabrication to industrial-scale production, with several key players and technological trends shaping the landscape.

Material innovation remains central to progress. Traditional substrates such as FR4 and Rogers laminates are being supplemented by advanced ceramics, flexible polymers, and low-loss dielectrics to achieve superior electromagnetic properties and mechanical robustness. Companies like Rogers Corporation are at the forefront, supplying high-frequency laminates specifically engineered for metamaterial structures, enabling low-loss and high-precision performance in the microwave regime.

Additive manufacturing (AM) and advanced lithography are revolutionizing the fabrication of complex metamaterial geometries. Direct-write printing and inkjet-based processes allow for rapid prototyping and customization, while maintaining the fine feature sizes required for sub-wavelength structuring. Nanoscribe is notable for its high-resolution 3D microfabrication systems, which are increasingly being adopted for prototyping and small-batch production of microwave metamaterial components.

Scalability is a critical challenge as demand grows for larger-area and higher-volume metamaterial panels. Roll-to-roll (R2R) processing and automated assembly lines are being developed to address this, with companies such as Flex leveraging their expertise in flexible electronics manufacturing to explore scalable production of conformal and flexible metamaterial surfaces. These approaches are expected to reduce costs and enable integration into commercial devices, such as antennas and radomes, over the next few years.

Quality control and repeatability are also being enhanced through in-line metrology and automated inspection systems. Industry leaders like Carl Zeiss AG provide advanced optical and electron microscopy solutions for real-time monitoring of metamaterial fabrication, ensuring consistency and performance at scale.

Looking ahead, the convergence of material science, precision manufacturing, and automation is set to accelerate the commercialization of microwave metamaterials. The next few years will likely see increased collaboration between material suppliers, equipment manufacturers, and end-users, driving down costs and expanding the range of deployable metamaterial-enabled products in wireless communications, automotive radar, and beyond.

Regulatory Landscape and Standardization Efforts

The regulatory landscape and standardization efforts for microwave metamaterials engineering are evolving rapidly as the technology matures and finds increasing adoption in telecommunications, defense, and sensing applications. As of 2025, the primary focus is on ensuring electromagnetic compatibility, safety, and interoperability, particularly as metamaterials are integrated into critical infrastructure such as 5G/6G networks, radar systems, and advanced antenna arrays.

Internationally, the International Electrotechnical Commission (IEC) and the International Telecommunication Union (ITU) are the leading bodies addressing standardization for electromagnetic materials and devices. The IEC’s Technical Committee 113, which covers nanotechnology for electrotechnical products and systems, has begun to address the unique properties and measurement challenges posed by metamaterials, including their frequency-selective behavior and tunability. Meanwhile, the ITU is monitoring the impact of metamaterial-based devices on spectrum management and interference mitigation, especially as these materials enable novel functionalities such as beam steering and cloaking in the microwave regime.

In the United States, the Federal Communications Commission (FCC) is responsible for regulating devices that emit or manipulate electromagnetic waves, including those incorporating metamaterials. The FCC’s equipment authorization process is being updated to account for the non-traditional electromagnetic responses of metamaterial-based antennas and filters, with a focus on ensuring compliance with existing emission and exposure limits. The National Institute of Standards and Technology (NIST) is also actively developing measurement protocols and reference materials to support industry adoption and regulatory compliance.

On the industry side, major players such as Nokia and Ericsson are participating in standardization working groups to ensure that metamaterial-enabled components can be seamlessly integrated into next-generation wireless infrastructure. These companies are collaborating with standards bodies to define performance metrics, testing methodologies, and interoperability requirements for metamaterial-based devices, particularly in the context of massive MIMO and reconfigurable intelligent surfaces.

Looking ahead, the next few years are expected to see the publication of the first dedicated standards for microwave metamaterials, covering aspects such as material characterization, device performance, and system-level integration. As regulatory frameworks adapt, close cooperation between industry, standards organizations, and regulatory agencies will be essential to unlock the full potential of microwave metamaterials while ensuring safety, reliability, and global interoperability.

Investment Trends, M&A, and Startup Ecosystem

The investment landscape for microwave metamaterials engineering is experiencing notable momentum in 2025, driven by the expanding applications in telecommunications, defense, automotive radar, and satellite communications. Venture capital and corporate investments are increasingly targeting startups and scale-ups that demonstrate breakthroughs in tunable, low-loss, and scalable metamaterial solutions. The sector is characterized by a blend of established players and agile startups, with a growing number of strategic partnerships and acquisitions shaping the competitive dynamics.

Key industry leaders such as Kuantum and Meta Materials Inc. are actively investing in R&D and expanding their intellectual property portfolios. Meta Materials Inc., for example, has continued to secure funding rounds to accelerate the commercialization of its microwave and radio-frequency (RF) metamaterial products, targeting both defense and commercial markets. The company’s collaborations with aerospace and defense contractors underscore the strategic importance of metamaterials in next-generation radar and stealth technologies.

On the startup front, companies like Kymeta Corporation are attracting significant attention for their electronically steerable metamaterial antennas, which are being adopted in satellite communications and connected vehicle platforms. Kymeta Corporation has reported new investment rounds in 2024 and 2025, with participation from both traditional aerospace investors and technology-focused venture funds. Their partnerships with satellite operators and automotive OEMs highlight the cross-sectoral appeal of microwave metamaterial innovations.

Mergers and acquisitions (M&A) activity is also intensifying. Larger defense and telecommunications firms are acquiring or forming joint ventures with metamaterial startups to secure access to proprietary technologies and accelerate time-to-market. For instance, Lockheed Martin and Northrop Grumman have both announced collaborations and minority investments in companies specializing in advanced microwave metamaterials, aiming to integrate these materials into radar, communications, and electronic warfare systems.

Looking ahead, the outlook for investment and startup activity in microwave metamaterials engineering remains robust. The convergence of 5G/6G infrastructure rollouts, autonomous vehicle sensor demands, and defense modernization programs is expected to sustain high levels of funding and M&A through at least 2027. As manufacturing scalability improves and regulatory pathways become clearer, more startups are anticipated to enter the market, further intensifying competition and innovation.

Future Outlook: Innovation Roadmap and Long-Term Opportunities

The future of microwave metamaterials engineering is poised for significant advancements as the field transitions from laboratory-scale demonstrations to scalable, real-world applications. As of 2025, the innovation roadmap is shaped by the convergence of advanced materials science, precision manufacturing, and the growing demand for high-performance electromagnetic devices across telecommunications, defense, and sensing industries.

Key industry players are accelerating the commercialization of tunable and reconfigurable metamaterials. Companies such as Northrop Grumman and Lockheed Martin are actively developing microwave metamaterial-based antennas and radomes for next-generation radar and communication systems, leveraging the ability of these materials to manipulate electromagnetic waves with unprecedented control. These efforts are supported by ongoing collaborations with government agencies and research institutions, aiming to enhance stealth, bandwidth, and signal integrity in both military and civilian platforms.

In the telecommunications sector, the rollout of 5G and the anticipated evolution toward 6G networks are driving demand for compact, high-efficiency components. Companies like Ericsson and Nokia are exploring metamaterial-enabled solutions for beam steering, interference mitigation, and miniaturized filters, which are critical for dense urban deployments and the Internet of Things (IoT). The integration of metamaterials into base station hardware and user devices is expected to accelerate over the next few years, with pilot deployments and field trials already underway.

Manufacturing scalability remains a central challenge and opportunity. Advances in additive manufacturing and nanofabrication are enabling the production of complex metamaterial structures at commercially viable scales. Companies such as 3D Systems are investing in precision additive manufacturing platforms tailored for high-frequency applications, which is expected to lower costs and expand design possibilities.

Looking ahead, the next few years will likely see the emergence of adaptive and multifunctional microwave metamaterials, capable of real-time reconfiguration in response to environmental stimuli or operational requirements. This will open new markets in adaptive sensing, wireless power transfer, and secure communications. The long-term outlook is further bolstered by international standardization efforts and increased investment from both public and private sectors, positioning microwave metamaterials as a foundational technology for future wireless infrastructure and advanced defense systems.

Sources & References

- Nokia

- Lockheed Martin

- Northrop Grumman

- Meta Materials Inc.

- CST (a Dassault Systèmes brand)

- Rogers Corporation

- Raytheon Technologies

- Airbus

- Honeywell

- Thales Group

- National Institute of Standards and Technology (NIST)

- Institute of Electrical and Electronics Engineers (IEEE)

- Nanoscribe

- Flex

- Carl Zeiss AG

- International Telecommunication Union

- 3D Systems